Who We Are

PO-FSA is a non-governmental organization established in the year 2000 with the independent responsibility to grant exclusive global private and offshore banking license to qualified entities through the registration of an acceptable International Business Company (IBC) in good standing. PO-FSA was established under the banking laws (POBA; 2000 [Electronic Money Regulation]) of the National Bank of the FR Yugoslavia, which now forms part of the Independent and Sovereign Republic of Montenegro. The exclusive global private and offshore banking license preceded the breakup of Yugoslavia after the wars because the banking laws that warranted its establishment made the PO-FSA autonomous and independent from the National Bank of FR Yugoslavia. The drafters of the banking laws (POBA; 2000 [Electronic Money Regulation]) saw into the future as the internet and technology advanced with need for banks to operate electronic transactions only through private and offshore banking license with global coverage. The banking laws that govern the PO-FSA only grants global banking and offshore banking license to entities that meet the rigorous requirements, and the bank must operate outside the jurisdictions of former FR Yugoslavia, including SR Serbia, SR Montenegro, and Autonomous Province of Kosovo.

The breakup of Yugoslavia was a process in which the Socialist Federal Republic of Yugoslavia was broken up into constituent republics, and over the course of which the Yugoslav wars started. The process generally began with the death of Josip Broz Tito on 4 May 1980 and formally ended when the last two remaining republics (SR Serbia and SR Montenegro) proclaimed the Federal Republic of Yugoslavia on 27 April 1992. At that time the Yugoslav wars were still ongoing, and FR Yugoslavia continued to exist until 2003, when it was renamed and reformed as the state union of Serbia and Montenegro. This union lasted until 5 June 2006 when Montenegro proclaimed independence. The former Yugoslav autonomous province of Kosovo subsequently proclaimed independence from Serbia in February 2008.

Despite the extinction of FR Yugoslavia in 2003, the PO-FSA was still in existence of granting exclusive private and offshore banking license to interested entities who wish to operate their bank outside the jurisdictions of SR Serbia, SR Montenegro, and Autonomous Province of Kosovo. Not until recently, the verification and confirmation of the banking license issued by PO-FSA could not be ascertained through the internet. The PO-FSA operated its verification and confirmation process through orthodox means of communication such as fax, registered mail, and telex through the bank the license was granted. PO-FSA did not share to the public information of the bank it grants its license because of the preservation of confidentiality but with the advancement of technology and Internet, the PO-FSA has made it mandatory to allow the public access such information, which also include the confirmation and verification process to ascertain the current status of the banks, which the PO-FSA granted its banking license.

History: FR Yugoslavia & SR Montenegro

Yugoslavia; Slovene; Macedonian ("Southern Slav Land") was a country in Southeastern and Central Europe for most of the 20th century. It came into existence after World War I in 1918 under the name of the Kingdom of Serbs, Croats and Slovenes by the merger of the provisional State of Slovenes, Croats and Serbs (it was formed from territories of the former Austro-Hungarian Empire) with the Kingdom of Serbia, and constituted the first union of the South Slavic people as a sovereign state, following centuries in which the region had been part of the Ottoman Empire and Austria-Hungary. Peter I of Serbia was its first sovereign. The kingdom gained international recognition on 13 July 1922 at the Conference of Ambassadors in Paris.The official name of the state was changed to Kingdom of Yugoslavia on 3 October 1929.

Yugoslavia was invaded by the Axis powers on 6 April 1941. In 1943, a Democratic Federal Yugoslavia was proclaimed by the Partisan resistance. In 1944 King Peter II, then living in exile, recognised it as the legitimate government. The monarchy was subsequently abolished in November 1945. Yugoslavia was renamed the Federal People's Republic of Yugoslavia in 1946, when a communist government was established. It acquired the territories of Istria, Rijeka, and Zadar from Italy. Partisan leader Josip Broz Tito ruled the country as president until his death in 1980. In 1963, the country was renamed again, as the Socialist Federal Republic of Yugoslavia (SFRY).

The six constituent republics that made up the SFRY were the SR Bosnia and Herzegovina, SR Croatia, SR Macedonia, SR Montenegro, SR Serbia, and SR Slovenia. Serbia contained two Socialist Autonomous Provinces, Vojvodina and Kosovo, which after 1974 were largely equal to the other members of the federation.After an economic and political crisis in the 1980s and the rise of nationalism, Yugoslavia broke up along its republics' borders, at first into five countries, leading to the Yugoslav Wars. From 1993 to 2017, the International Criminal Tribunal for the former Yugoslavia tried political and military leaders from the former Yugoslavia for war crimes, genocide, and other crimes committed during those wars.

After the breakup, the republics of Montenegro and Serbia formed a reduced federative state, Serbia and Montenegro, known officially until 2003 as the Federal Republic of Yugoslavia (FRY). This state aspired to the status of sole legal successor to the SFRY, but those claims were opposed by the other former republics. Eventually, it accepted the opinion of the Badinter Arbitration Committee about shared successionand in 2003 its official name was changed to Serbia and Montenegro. This state dissolved when Montenegro and Serbia each became independent states in 2006, while Kosovo proclaimed its independence from Serbia in 2008.

Banking Law (POBA; 2000 [Electronic Money Regulation])

Obtaining global private and offshore banking license from PO-FSA requires interested parties to meet certain requirements under the Banking Law (POBA; 2000 [Electronic Money Regulation]). The banking law stipulates the following:

Conditions of Banking License

Legislation

The PO-FSA models the United Nations (Anti-Terrorism Measures) and the International Monetary Fund - IMF (Financial Intelligence Units) as part of the banking law framework. These frameworks not only allow for proactive and dynamic approach to the private and offshore banking business, but equally as important the evolving frameworks focus closely on the reduction of money laundering and any form of financial crime. The United Names (Anti-Terrorism Measures) makes provision of the International Convention for the Suppression of Terrorism, 1999, and to provide measures to combat terrorism.

The IMF (Financial Intelligence Units & Financial Regulatory Authorities) in response to the need for countries to have a central agency to receive, analyze, and disseminate financial information to combat money laundering. Over the ensuing period, the number of FIUs has continued to increase, reaching 84 in 2003.

UN - Counter Terrorism

IMF - Financial Intelligence Units

FIU - Transparency International

FIU - Member List

Verify License

To obtain current status of any (IBC) registered with the PO-FSA to offer private and offshore banking services, please search here with the License Number. You can also check for the (IBC) that have had their license suspended or revoked.

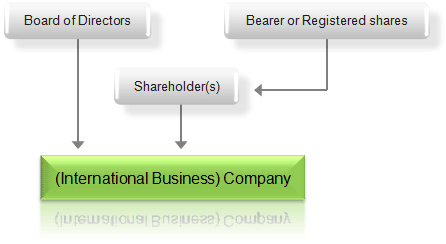

International Business Company (IBC)

An international business company or international business corporation (IBC) is an offshore company formed under the laws of some jurisdictions as a tax neutral company which is usually limited in terms of the activities it may conduct in, but not necessarily from, the jurisdiction in which it is incorporated. While not taxable in the country of incorporation, an IBC or its owners, if resident in a country having "controlled foreign corporation" rules for instance can be taxable in other jurisdictions.

Characteristics of an IBC vary by jurisdiction, but will usually include:

All of the above characteristics are also attributable to many "onshore" countries which have either a residency or territorial based tax system where setting up a company, LLC or LLP in the jurisdiction along with the use of "nominees" will offer all of the above characteristics. US LLCs, UK LLPs and Hong Kong companies are all examples which are widely used in similar capacity to IBCs and which meet all the characteristics above.

However, under pressure from the Organization for Economic Co-operation and Development (OECD) and the Financial Action Task Force on Money Laundering (FATF), most offshore jurisdictions have removed or are removing the "ring fencing" of IBCs from local taxation. In most of the jurisdictions, this has been accompanied by reductions of levels of corporate tax to zero to avoid damaging the offshore finance industry.

Further, most jurisdictions have either eliminated or highly restricted the issuing of bearer shares by IBCs due to international pressures.

Functions of IBC companies mirror those of offshore companies. Offshore companies are not necessarily IBC entities, but all IBC companies are essentially offshore companies. Functions of these companies includes:

The presence of common documents and procedures is not required for compliance's sake. They are exempt from this and are expected to handle their problems and complications without the knowledge of authorities and the general public. They often retain the ability to allocate registered shares and the now outdated bearer shares. These were outlawed as they wielded excessive power and were too wild a card to have in the proverbial deck.

Banking License Checklist

The PO-FSA considers the following criteria when granting an Exclusive Private & Offshore Banking license to International Business Company (IBC) in good standing:

It is imperative for the IBC to meet the above-mentioned criteria as a prerequisite to accord the PO-FSA the level of assurance that the bank will be properly managed and successfully operated to meet the needs of both depositors and creditors.

The aim of the Checklist is to help the IBC as a guideline in processing its application. The IBC is required to follow these guidelines of the Checklist to ensure the successful process of the application. The Checklist is not an exhaustive list and the PO-FSA has the right to seek additional information to align with the criteria mentioned above.

Important Information

All documents, which are in a foreign language should be accompanied by a notarized English translation. The English translation should be completed by a qualified translator. Additionally, all relevant Contracts including other applications in process should be dated and signed by the shareholders or directors of the IBC and original copies submitted to the PO-FSA. As indicated the PO-FSA reserves the right to request further documentation or explanation with respect to any application.

Failure to disclose relevant information or provision of false, misleading or inaccurate information at the application stage may have serious consequences for the IBC and will result in significant delay to the authorization process or rejection of the application, which will question the suitability of the IBC.

The entire application process is estimated to take 6 months to 1 year, dependent upon the requisite information and documentation provided by IBC in good standing. Successful applications are approved by the Executive Board, which seats and meets twice a year.

Who We Are

PO-FSA is a non-governmental organization established in the year 2000 with the independent responsibility to grant exclusive global private and offshore banking license to qualified entities through the registration of an acceptable International Business Company (IBC) in good standing. PO-FSA was established under the banking laws (POBA; 2000 [Electronic Money Regulation]) of the National Bank of the FR Yugoslavia, which now forms part of the Independent and Sovereign Republic of Montenegro. The exclusive global private and offshore banking license preceded the breakup of Yugoslavia after the wars because the banking laws that warranted its establishment made the PO-FSA autonomous and independent from the National Bank of FR Yugoslavia. The drafters of the banking laws (POBA; 2000 [Electronic Money Regulation]) saw into the future as the internet and technology advanced with need for banks to operate electronic transactions only through private and offshore banking license with global coverage. The banking laws that govern the PO-FSA only grants global banking and offshore banking license to entities that meet the rigorous requirements, and the bank must operate outside the jurisdictions of former FR Yugoslavia, including SR Serbia, SR Montenegro, and Autonomous Province of Kosovo.

The breakup of Yugoslavia was a process in which the Socialist Federal Republic of Yugoslavia was broken up into constituent republics, and over the course of which the Yugoslav wars started. The process generally began with the death of Josip Broz Tito on 4 May 1980 and formally ended when the last two remaining republics (SR Serbia and SR Montenegro) proclaimed the Federal Republic of Yugoslavia on 27 April 1992. At that time the Yugoslav wars were still ongoing, and FR Yugoslavia continued to exist until 2003, when it was renamed and reformed as the state union of Serbia and Montenegro. This union lasted until 5 June 2006 when Montenegro proclaimed independence. The former Yugoslav autonomous province of Kosovo subsequently proclaimed independence from Serbia in February 2008.

Despite the extinction of FR Yugoslavia in 2003, the PO-FSA was still in existence of granting exclusive private and offshore banking license to interested entities who wish to operate their bank outside the jurisdictions of SR Serbia, SR Montenegro, and Autonomous Province of Kosovo. Not until recently, the verification and confirmation of the banking license issued by PO-FSA could not be ascertained through the internet. The PO-FSA operated its verification and confirmation process through orthodox means of communication such as fax, registered mail, and telex through the bank the license was granted. PO-FSA did not share to the public information of the bank it grants its license because of the preservation of confidentiality but with the advancement of technology and Internet, the PO-FSA has made it mandatory to allow the public access such information, which also include the confirmation and verification process to ascertain the current status of the banks, which the PO-FSA granted its banking license.

History: FR Yugoslavia & SR Montenegro

Yugoslavia; Slovene; Macedonian ("Southern Slav Land") was a country in Southeastern and Central Europe for most of the 20th century. It came into existence after World War I in 1918 under the name of the Kingdom of Serbs, Croats and Slovenes by the merger of the provisional State of Slovenes, Croats and Serbs (it was formed from territories of the former Austro-Hungarian Empire) with the Kingdom of Serbia, and constituted the first union of the South Slavic people as a sovereign state, following centuries in which the region had been part of the Ottoman Empire and Austria-Hungary. Peter I of Serbia was its first sovereign. The kingdom gained international recognition on 13 July 1922 at the Conference of Ambassadors in Paris.The official name of the state was changed to Kingdom of Yugoslavia on 3 October 1929.

Yugoslavia was invaded by the Axis powers on 6 April 1941. In 1943, a Democratic Federal Yugoslavia was proclaimed by the Partisan resistance. In 1944 King Peter II, then living in exile, recognised it as the legitimate government. The monarchy was subsequently abolished in November 1945. Yugoslavia was renamed the Federal People's Republic of Yugoslavia in 1946, when a communist government was established. It acquired the territories of Istria, Rijeka, and Zadar from Italy. Partisan leader Josip Broz Tito ruled the country as president until his death in 1980. In 1963, the country was renamed again, as the Socialist Federal Republic of Yugoslavia (SFRY).

The six constituent republics that made up the SFRY were the SR Bosnia and Herzegovina, SR Croatia, SR Macedonia, SR Montenegro, SR Serbia, and SR Slovenia. Serbia contained two Socialist Autonomous Provinces, Vojvodina and Kosovo, which after 1974 were largely equal to the other members of the federation.After an economic and political crisis in the 1980s and the rise of nationalism, Yugoslavia broke up along its republics' borders, at first into five countries, leading to the Yugoslav Wars. From 1993 to 2017, the International Criminal Tribunal for the former Yugoslavia tried political and military leaders from the former Yugoslavia for war crimes, genocide, and other crimes committed during those wars.

After the breakup, the republics of Montenegro and Serbia formed a reduced federative state, Serbia and Montenegro, known officially until 2003 as the Federal Republic of Yugoslavia (FRY). This state aspired to the status of sole legal successor to the SFRY, but those claims were opposed by the other former republics. Eventually, it accepted the opinion of the Badinter Arbitration Committee about shared successionand in 2003 its official name was changed to Serbia and Montenegro. This state dissolved when Montenegro and Serbia each became independent states in 2006, while Kosovo proclaimed its independence from Serbia in 2008.

Banking Law (POBA; 2000 [Electronic Money Regulation])

Obtaining global private and offshore banking license from PO-FSA requires interested parties to meet certain requirements under the Banking Law (POBA; 2000 [Electronic Money Regulation]). The banking law stipulates the following:

Conditions of Banking License

Legislation

The PO-FSA models the United Nations (Anti-Terrorism Measures) and the International Monetary Fund - IMF (Financial Intelligence Units) as part of the banking law framework. These frameworks not only allow for proactive and dynamic approach to the private and offshore banking business, but equally as important the evolving frameworks focus closely on the reduction of money laundering and any form of financial crime. The United Names (Anti-Terrorism Measures) makes provision of the International Convention for the Suppression of Terrorism, 1999, and to provide measures to combat terrorism.

The IMF (Financial Intelligence Units & Financial Regulatory Authorities) in response to the need for countries to have a central agency to receive, analyze, and disseminate financial information to combat money laundering. Over the ensuing period, the number of FIUs has continued to increase, reaching 84 in 2003.

UN - Counter Terrorism

IMF - Financial Intelligence Units

FIU - Transparency International

FIU - Member List

Verify License

To obtain current status of any (IBC) registered with the PO-FSA to offer private and offshore banking services, please search here with the License Number. You can also check for the (IBC) that have had their license suspended or revoked.

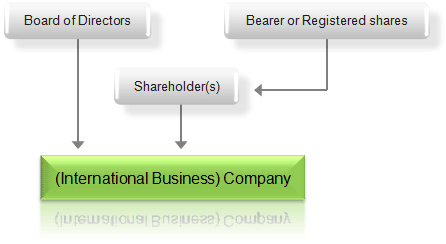

International Business Company (IBC)

An international business company or international business corporation (IBC) is an offshore company formed under the laws of some jurisdictions as a tax neutral company which is usually limited in terms of the activities it may conduct in, but not necessarily from, the jurisdiction in which it is incorporated. While not taxable in the country of incorporation, an IBC or its owners, if resident in a country having "controlled foreign corporation" rules for instance can be taxable in other jurisdictions.

Characteristics of an IBC vary by jurisdiction, but will usually include:

All of the above characteristics are also attributable to many "onshore" countries which have either a residency or territorial based tax system where setting up a company, LLC or LLP in the jurisdiction along with the use of "nominees" will offer all of the above characteristics. US LLCs, UK LLPs and Hong Kong companies are all examples which are widely used in similar capacity to IBCs and which meet all the characteristics above.

However, under pressure from the Organization for Economic Co-operation and Development (OECD) and the Financial Action Task Force on Money Laundering (FATF), most offshore jurisdictions have removed or are removing the "ring fencing" of IBCs from local taxation. In most of the jurisdictions, this has been accompanied by reductions of levels of corporate tax to zero to avoid damaging the offshore finance industry.

Further, most jurisdictions have either eliminated or highly restricted the issuing of bearer shares by IBCs due to international pressures.

Functions of IBC companies mirror those of offshore companies. Offshore companies are not necessarily IBC entities, but all IBC companies are essentially offshore companies. Functions of these companies includes:

The presence of common documents and procedures is not required for compliance's sake. They are exempt from this and are expected to handle their problems and complications without the knowledge of authorities and the general public. They often retain the ability to allocate registered shares and the now outdated bearer shares. These were outlawed as they wielded excessive power and were too wild a card to have in the proverbial deck.

Banking License Checklist

The PO-FSA considers the following criteria when granting an Exclusive Private & Offshore Banking license to International Business Company (IBC) in good standing:

It is imperative for the IBC to meet the above-mentioned criteria as a prerequisite to accord the PO-FSA the level of assurance that the bank will be properly managed and successfully operated to meet the needs of both depositors and creditors.

The aim of the Checklist is to help the IBC as a guideline in processing its application. The IBC is required to follow these guidelines of the Checklist to ensure the successful process of the application. The Checklist is not an exhaustive list and the PO-FSA has the right to seek additional information to align with the criteria mentioned above.

Important Information

All documents, which are in a foreign language should be accompanied by a notarized English translation. The English translation should be completed by a qualified translator. Additionally, all relevant Contracts including other applications in process should be dated and signed by the shareholders or directors of the IBC and original copies submitted to the PO-FSA. As indicated the PO-FSA reserves the right to request further documentation or explanation with respect to any application.

Failure to disclose relevant information or provision of false, misleading or inaccurate information at the application stage may have serious consequences for the IBC and will result in significant delay to the authorization process or rejection of the application, which will question the suitability of the IBC.

The entire application process is estimated to take 6 months to 1 year, dependent upon the requisite information and documentation provided by IBC in good standing. Successful applications are approved by the Executive Board, which seats and meets twice a year.

Who We Are

PO-FSA is a non-governmental organization established in the year 2000 with the independent responsibility to grant exclusive global private and offshore banking license to qualified entities through the registration of an acceptable International Business Company (IBC) in good standing. PO-FSA was established under the banking laws (POBA; 2000 [Electronic Money Regulation]) of the National Bank of the FR Yugoslavia, which now forms part of the Independent and Sovereign Republic of Montenegro. The exclusive global private and offshore banking license preceded the breakup of Yugoslavia after the wars because the banking laws that warranted its establishment made the PO-FSA autonomous and independent from the National Bank of FR Yugoslavia. The drafters of the banking laws (POBA; 2000 [Electronic Money Regulation]) saw into the future as the internet and technology advanced with need for banks to operate electronic transactions only through private and offshore banking license with global coverage. The banking laws that govern the PO-FSA only grants global banking and offshore banking license to entities that meet the rigorous requirements, and the bank must operate outside the jurisdictions of former FR Yugoslavia, including SR Serbia, SR Montenegro, and Autonomous Province of Kosovo.

The breakup of Yugoslavia was a process in which the Socialist Federal Republic of Yugoslavia was broken up into constituent republics, and over the course of which the Yugoslav wars started. The process generally began with the death of Josip Broz Tito on 4 May 1980 and formally ended when the last two remaining republics (SR Serbia and SR Montenegro) proclaimed the Federal Republic of Yugoslavia on 27 April 1992. At that time the Yugoslav wars were still ongoing, and FR Yugoslavia continued to exist until 2003, when it was renamed and reformed as the state union of Serbia and Montenegro. This union lasted until 5 June 2006 when Montenegro proclaimed independence. The former Yugoslav autonomous province of Kosovo subsequently proclaimed independence from Serbia in February 2008.

Despite the extinction of FR Yugoslavia in 2003, the PO-FSA was still in existence of granting exclusive private and offshore banking license to interested entities who wish to operate their bank outside the jurisdictions of SR Serbia, SR Montenegro, and Autonomous Province of Kosovo. Not until recently, the verification and confirmation of the banking license issued by PO-FSA could not be ascertained through the internet. The PO-FSA operated its verification and confirmation process through orthodox means of communication such as fax, registered mail, and telex through the bank the license was granted. PO-FSA did not share to the public information of the bank it grants its license because of the preservation of confidentiality but with the advancement of technology and Internet, the PO-FSA has made it mandatory to allow the public access such information, which also include the confirmation and verification process to ascertain the current status of the banks, which the PO-FSA granted its banking license.

History: FR Yugoslavia & SR Montenegro

Yugoslavia; Slovene; Macedonian ("Southern Slav Land") was a country in Southeastern and Central Europe for most of the 20th century. It came into existence after World War I in 1918 under the name of the Kingdom of Serbs, Croats and Slovenes by the merger of the provisional State of Slovenes, Croats and Serbs (it was formed from territories of the former Austro-Hungarian Empire) with the Kingdom of Serbia, and constituted the first union of the South Slavic people as a sovereign state, following centuries in which the region had been part of the Ottoman Empire and Austria-Hungary. Peter I of Serbia was its first sovereign. The kingdom gained international recognition on 13 July 1922 at the Conference of Ambassadors in Paris.The official name of the state was changed to Kingdom of Yugoslavia on 3 October 1929.

Yugoslavia was invaded by the Axis powers on 6 April 1941. In 1943, a Democratic Federal Yugoslavia was proclaimed by the Partisan resistance. In 1944 King Peter II, then living in exile, recognised it as the legitimate government. The monarchy was subsequently abolished in November 1945. Yugoslavia was renamed the Federal People's Republic of Yugoslavia in 1946, when a communist government was established. It acquired the territories of Istria, Rijeka, and Zadar from Italy. Partisan leader Josip Broz Tito ruled the country as president until his death in 1980. In 1963, the country was renamed again, as the Socialist Federal Republic of Yugoslavia (SFRY).

The six constituent republics that made up the SFRY were the SR Bosnia and Herzegovina, SR Croatia, SR Macedonia, SR Montenegro, SR Serbia, and SR Slovenia. Serbia contained two Socialist Autonomous Provinces, Vojvodina and Kosovo, which after 1974 were largely equal to the other members of the federation.After an economic and political crisis in the 1980s and the rise of nationalism, Yugoslavia broke up along its republics' borders, at first into five countries, leading to the Yugoslav Wars. From 1993 to 2017, the International Criminal Tribunal for the former Yugoslavia tried political and military leaders from the former Yugoslavia for war crimes, genocide, and other crimes committed during those wars.

After the breakup, the republics of Montenegro and Serbia formed a reduced federative state, Serbia and Montenegro, known officially until 2003 as the Federal Republic of Yugoslavia (FRY). This state aspired to the status of sole legal successor to the SFRY, but those claims were opposed by the other former republics. Eventually, it accepted the opinion of the Badinter Arbitration Committee about shared successionand in 2003 its official name was changed to Serbia and Montenegro. This state dissolved when Montenegro and Serbia each became independent states in 2006, while Kosovo proclaimed its independence from Serbia in 2008.

Banking Law (POBA; 2000 [Electronic Money Regulation])

Obtaining global private and offshore banking license from PO-FSA requires interested parties to meet certain requirements under the Banking Law (POBA; 2000 [Electronic Money Regulation]). The banking law stipulates the following:

Conditions of Banking License

Legislation

The PO-FSA models the United Nations (Anti-Terrorism Measures) and the International Monetary Fund - IMF (Financial Intelligence Units) as part of the banking law framework. These frameworks not only allow for proactive and dynamic approach to the private and offshore banking business, but equally as important the evolving frameworks focus closely on the reduction of money laundering and any form of financial crime. The United Names (Anti-Terrorism Measures) makes provision of the International Convention for the Suppression of Terrorism, 1999, and to provide measures to combat terrorism.

The IMF (Financial Intelligence Units & Financial Regulatory Authorities) in response to the need for countries to have a central agency to receive, analyze, and disseminate financial information to combat money laundering. Over the ensuing period, the number of FIUs has continued to increase, reaching 84 in 2003.

UN - Counter Terrorism

IMF - Financial Intelligence Units

FIU - Transparency International

FIU - Member List

Verify License

To obtain current status of any (IBC) registered with the PO-FSA to offer private and offshore banking services, please search here with the License Number. You can also check for the (IBC) that have had their license suspended or revoked.

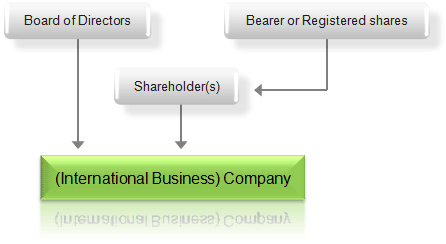

International Business Company (IBC)

An international business company or international business corporation (IBC) is an offshore company formed under the laws of some jurisdictions as a tax neutral company which is usually limited in terms of the activities it may conduct in, but not necessarily from, the jurisdiction in which it is incorporated. While not taxable in the country of incorporation, an IBC or its owners, if resident in a country having "controlled foreign corporation" rules for instance can be taxable in other jurisdictions.

Characteristics of an IBC vary by jurisdiction, but will usually include:

All of the above characteristics are also attributable to many "onshore" countries which have either a residency or territorial based tax system where setting up a company, LLC or LLP in the jurisdiction along with the use of "nominees" will offer all of the above characteristics. US LLCs, UK LLPs and Hong Kong companies are all examples which are widely used in similar capacity to IBCs and which meet all the characteristics above.

However, under pressure from the Organization for Economic Co-operation and Development (OECD) and the Financial Action Task Force on Money Laundering (FATF), most offshore jurisdictions have removed or are removing the "ring fencing" of IBCs from local taxation. In most of the jurisdictions, this has been accompanied by reductions of levels of corporate tax to zero to avoid damaging the offshore finance industry.

Further, most jurisdictions have either eliminated or highly restricted the issuing of bearer shares by IBCs due to international pressures.

Functions of IBC companies mirror those of offshore companies. Offshore companies are not necessarily IBC entities, but all IBC companies are essentially offshore companies. Functions of these companies includes:

The presence of common documents and procedures is not required for compliance's sake. They are exempt from this and are expected to handle their problems and complications without the knowledge of authorities and the general public. They often retain the ability to allocate registered shares and the now outdated bearer shares. These were outlawed as they wielded excessive power and were too wild a card to have in the proverbial deck.

Banking License Checklist

The PO-FSA considers the following criteria when granting an Exclusive Private & Offshore Banking license to International Business Company (IBC) in good standing:

It is imperative for the IBC to meet the above-mentioned criteria as a prerequisite to accord the PO-FSA the level of assurance that the bank will be properly managed and successfully operated to meet the needs of both depositors and creditors.

The aim of the Checklist is to help the IBC as a guideline in processing its application. The IBC is required to follow these guidelines of the Checklist to ensure the successful process of the application. The Checklist is not an exhaustive list and the PO-FSA has the right to seek additional information to align with the criteria mentioned above.

Important Information

All documents, which are in a foreign language should be accompanied by a notarized English translation. The English translation should be completed by a qualified translator. Additionally, all relevant Contracts including other applications in process should be dated and signed by the shareholders or directors of the IBC and original copies submitted to the PO-FSA. As indicated the PO-FSA reserves the right to request further documentation or explanation with respect to any application.

Failure to disclose relevant information or provision of false, misleading or inaccurate information at the application stage may have serious consequences for the IBC and will result in significant delay to the authorization process or rejection of the application, which will question the suitability of the IBC.

The entire application process is estimated to take 6 months to 1 year, dependent upon the requisite information and documentation provided by IBC in good standing. Successful applications are approved by the Executive Board, which seats and meets twice a year.

© Copyright PO-FSA Montenegro. All Rights Reserved